VOTE DISCLOSURE SERVICES

Setting the standards for vote disclosure best practices

Turnkey recordkeeping & disclosure services to help efficiently showcase active ownership and cost-effectively achieve compliance with global regulatory requirements, stewardship codes, and best practice guidelines.

With today’s focus on ESG, asset managers, mutual fund complexes, and asset owners are looking to showcase their active ownership, alongside meeting regulatory requirements, stewardship codes, and best practice standards for corporate governance disclosure.

ISS provides a fully outsourced solution to help investors tell their stewardship story, while also providing a cost-effective solution to meet regulatory mandates and best practice disclosure and transparency of voting policies and practices for investors in global markets.

Tell your stewardship narrative and meet regulatory & best practice standards for disclosure

- Branded vote disclosure website development and hosting to help you make your portfolio-level voting records accessible to clients and other stakeholders.

- Premium, interactive dashboards provide for dynamic display of voting records via statistical graphics, with the opportunity to highlight key votes

- Meet local market stakeholders needs with support for foreign language overlay in French, Dutch & German

HIGHLIGHT YOUR STEWARDSHIP PROGRAM WITH

ISS VOTE DISCLOSURE SERVICES

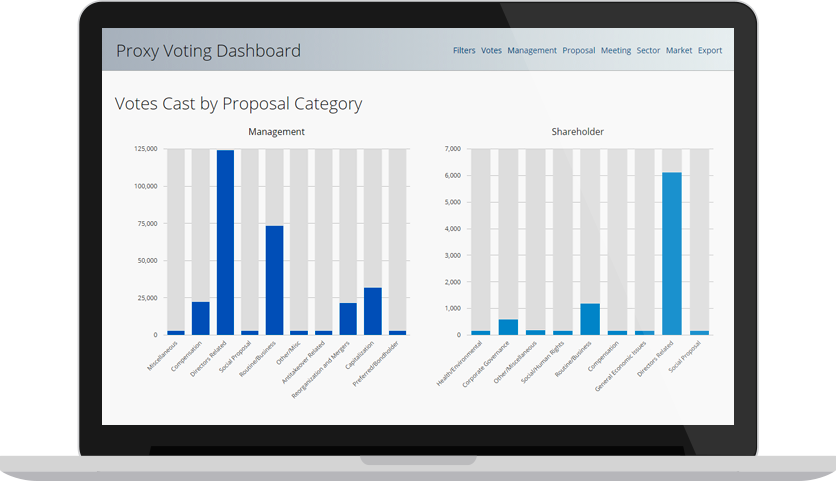

Customizable, interactive dashboard of graphical voting statistics, including:

-

- Votes Cast by Proposal Category

- Votes Cast by Type

- Alignment with Management

- Meetings by Type, Sector, Market

Flexibility to display information by portfolio, fund, issuer, market or meeting date, with the ability to drill into detailed meeting information for additional content.

Incorporate your branding, logo and color scheme into ISS hosted website to seamlessly make your policies and voting records available to stakeholders.

Export content for stakeholder reporting.

Select & highlight keys votes, such as votes against management or ESG shareholder proposals, and define “significant meetings” for disclosure, which can also assist with SRD II requirements.

Websites can allow for custom disclosure periods, including past meetings or meetings voted in advance of the meeting date, with the ability to search by fund, company, ticker, and meeting date.

Create a standalone site or embed vote records within your current public website structure for stakeholder disclosure.

Support for foreign language translation overlay in Dutch, French & German.

ISS Vote Disclosure Services can help you meet regulatory as well as best practice standard for

- US Securities and Exchange Commission Form N-PX

- National Instrument (NI) 81-106 website disclosure in Canada

- UN PRI Signatories

- UCITS Directive in Europe

- UK Stewardship Code

- EC Action Plan for Corporate Governance

- EU Shareholder Rights Directive II (SRD II)

- EFAMA Code for External Governance

- Minder Swiss Ordinance for Pension Fund Voting

- BVI Code of Conduct in Germany

- Eumedion Best Practices in Netherlands

- Assogestioni Principe in Italy

- Japan Stewardship Code

- Financial Services Council (FSC) Standard No. 13 and Standard No. 20 in Australia

- Stronger Super Reforms (RG 252) in Australia

Form N-PX Vote Disclosure Solution

ISS provides a turnkey, outsourced reporting preparation solution to help investors comply with SEC rules for Form N-PX disclosure of proxy voting records.

-

- ASCII or HTML reporting format plus NEW XML framework to meet SEC requirements

- Report on proxy voting matters and agenda items mandated for disclosure

- Quantitative disclosure of shares on loan and/or shares voted

Data management service through file transfer from third party sub-advisors, vote record ingestion, file creation for SEC Form N-PX, and file retention for record keeping.

Prepare to Meet New SEC Form N-PX Deadlines on Votes as of July 1, 2023.

FOR ’40 ACT FUNDS

FOR INVESTMENT MANAGERS