FEATURED SETTLEMENT

JP Morgan

J.P. Morgan Securities LLC recently agreed to a $280 million settlement Claim deadline on September 6, 2014. that may rank as one of the top 50 securities class action settlements tracked since the passage of the Private Securities Litigation Reform Act of 1995.

The complaint alleges that defendants issued false and misleading information in their Registration Statements and Prospectus Supplements during the class period. As a result of the misstatements and omissions, the Certificates sold to plaintiffs and the Class were secured by assets that had a much greater risk profile in the form of a statistically significant difference between the expected versus actual performance of such assets than represented in the Registration Statements, and defendants offered superior credit ratings on the Certificates as a result of defendants’ failure to disclose the underwriting defects and appraisal manipulations.

Case Names of Upcoming Settlements

(August 15 – September 15, 2014)

- Advanta Corp. (2009)

- City of Monticello, Minnesota

- Heckmann Corporation (n.k.a. Nuverra Environmental Solutions, Inc.) (D. Del.)

- Kosmos Energy Ltd.

- Weatherford International Ltd. (2011) (S.D.N.Y.)

- Oppenheimer AMT-Free Municipals Fund

- Oppenheimer AMT-Free New York Municipal Fund

- Oppenheimer New Jersey Municipal Fund

- Oppenheimer Pennsylvania Municipal Fund

- Oppenheimer Rochester Fund Municipals

- Oppenheimer Rochester National Municipal Fund

- Bernard L. Madoff Investment Securities LLC (2009) (S.D.N.Y.) (Austin Capital Management Ltd.)

- American Apparel, Inc.

- FindWhat.com, Inc. (n/k/a Vertro, Inc.)

- J.P. Morgan Acceptance Corp. I (Mortgage Pass-Through Certificates) (2008)

- GMX Resources Inc.

- Epicor Software Corporation (2011) (California Superior Court)

International Cases With Upcoming Registration Deadlines

| Case Name | Country | Registration Deadline |

| Macmahon Holdings Limited (2014) | Australia | 22-Aug-14 |

| Iluka Resources Ltd. | Australia | 22-Aug-14 |

| BP p.l.c. (2012) | Netherlands | 30-Sep-14 |

| WorleyParsons Limited | Australia | 3-Oct-14 |

| Billabong International Limited | Australia | Open* |

| OZ Minerals Limited (2014) (Zinifex Limited) | Australia | Open* |

| Allco Finance Group Limited | Australia | Open* |

* Law firm is yet to set the deadline.

List of Disbursements

| Settlement Name | Claim Deadline | Total Amount (USD) | Disbursement Date |

| Citigroup, Inc. (2007) | 7-Feb-13 | 590,000,000 | 25-Jul-14 |

| Lehman Brothers Holdings, Inc. (S.D.N.Y.) (Mortgage-Backed Securities) | 20-Aug-12 | 40,000,000 | 23-Jul-14 |

| Citigroup Mortgage Loan Trust, Inc. | 10-Jan-13 | 24,975,000 | 21-Jul-14 |

| Ener1, Inc. | 29-Jun-13 | 4,200,000 | 21-Jul-14 |

| Ikanos Communications, Inc. | 8-Jul-13 | 5,000,000 | 21-Jul-14 |

| Immucor, Inc. (2009) | 24-Jul-13 | 3,900,000 | 27-Jun-14 |

| SLM Corp. (Sallie Mae) (2008) | 31-Aug-12 | 35,000,000 | 27-Jun-14 |

| Pacific Biosciences of California, Inc. (California Superior Court) | 16-Oct-13 | 7,686,494 | 19-Jun-14 |

| STEC, Inc. (2009) | 25-Jun-13 | 35,750,000 | 19-Jun-14 |

| TechTeam Global, Inc. | 2-Jul-13 | 1,775,000 | 19-Jun-14 |

| The Titan Corp. (S.D. Cal.) | 9-Jan-06 | 61,500,000 | 19-Jun-14 |

| Pilgrim’s Pride Corporation | 9-Jun-12 | 1,500,000 | 11-Jun-14 |

| Alternate Energy Holdings, Inc. | 24-Sep-12 | 450,000 | 6-Jun-14 |

| Dynegy Inc. (SEC) (2002) | 21,750,000 | 6-Jun-14 | |

| Protective Products of America, Inc. (Canada) | 5-Apr-14 | 6-Jun-14 | |

| HealthSouth Corp. (2004) (Bondholder Class – UBS Defendants) | 29-Sep-10 | 100,000,000 | 6-Jun-14 |

| HealthSouth Corp. (2004) (Bondholder Class – E&Y) | 29-Sep-10 | 33,500,000 | 6-Jun-14 |

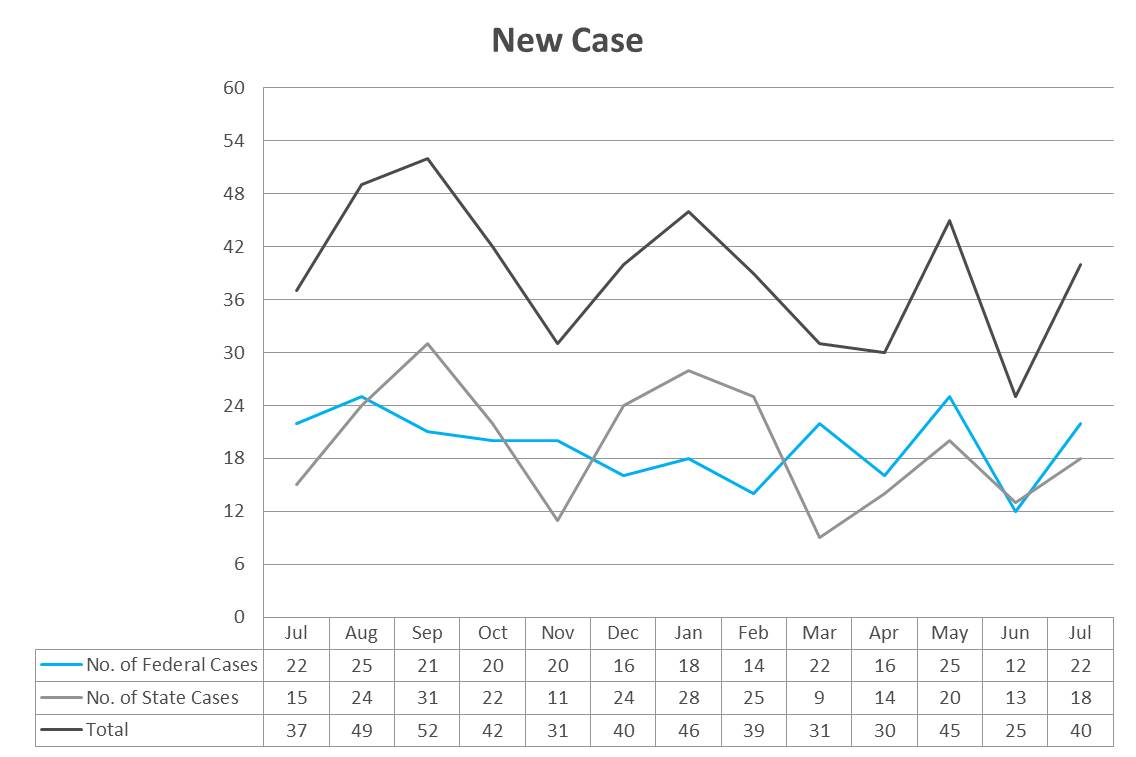

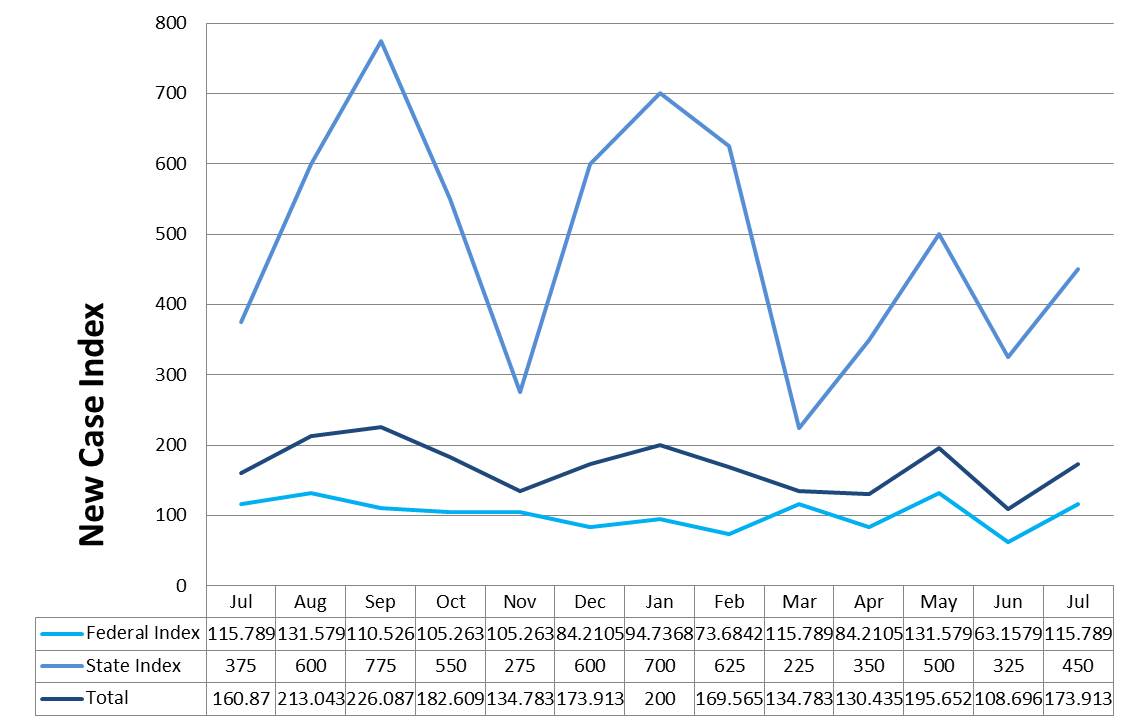

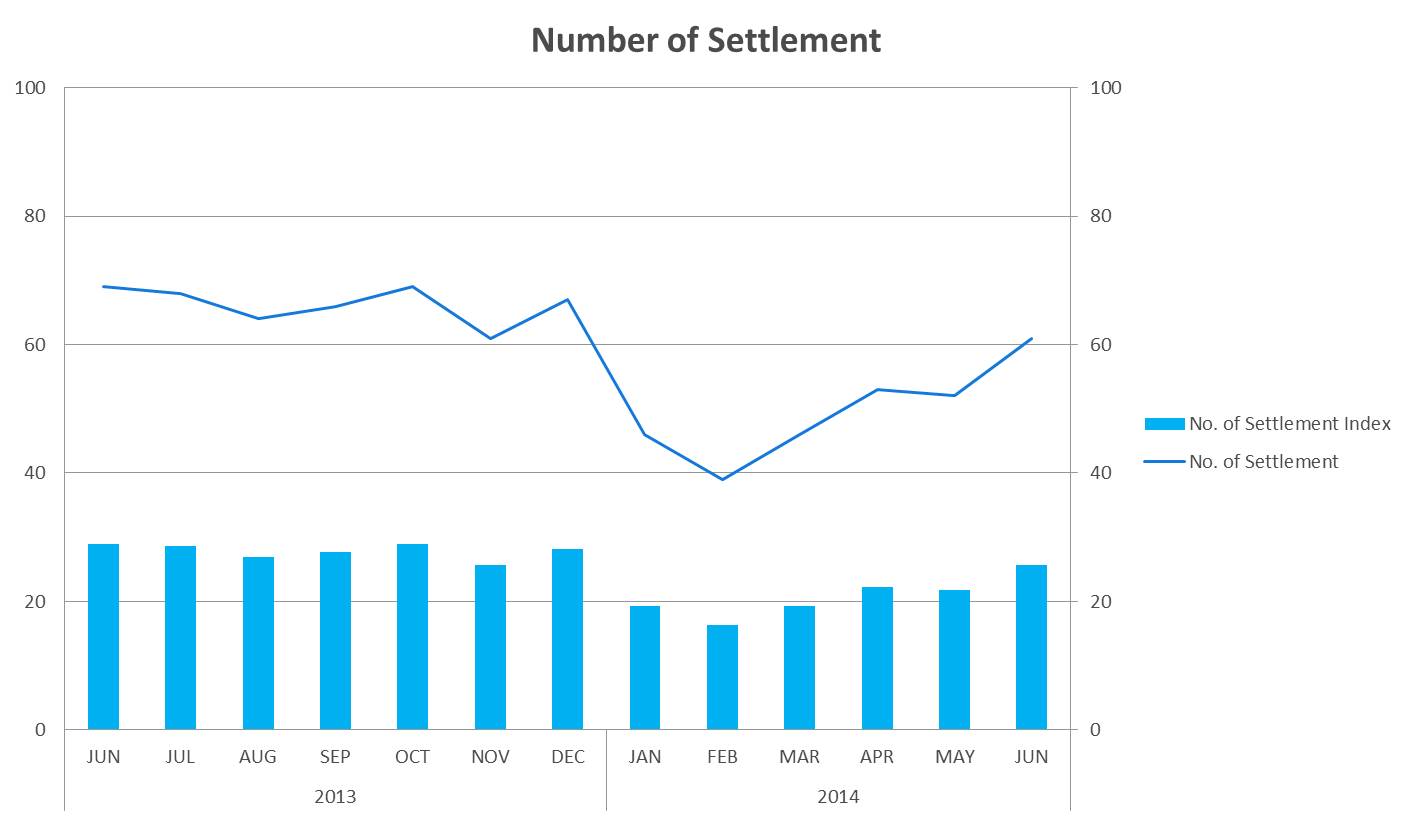

U.S. SETTLEMENT STATS

(August 15 – September 15, 2014)

Reports

Top 100 Settlements for 2H 2013

The Top 100 Settlements for the second half of 2013 reflects the addition of nine new cases with a total settlement value of USD 2.9 billion that was approved in the second half of the year. These represent some of the largest settlement recoveries since 2011.

Top 50 for 2013

The Securities Class Action Services Top 50 showcases plaintiff counsels ranked based on the total settlement amount which they have served as lead plaintiff and obtained final approval from the court.

Indices

Related Reads

SCOTUS REAFFIRMS ‘FRAUD-ON-THE-MARKET’ PRESUMPTION

In a highly anticipated ruling, the Supreme Court of the United States reaffirmed June 23 a more than quarter-century old decision allowing investors to sue companies based on a “fraud-on-the-market” presumption.