LIQUIDMETRIX

Independent provider of TCA, Best Execution, Surveillance, Venue Statistics & Research services.

Pre-Trade Planner

A sophisticated tool leveraging a new, alternative methodology for generating pre-trade cost estimates.

A CHOICE OF DELIVERY METHODS

Fully integrated within a cutting-edge Web interface,

including single-stock and basket management, charting and formatted PDF exports

Estimated Performance are also available

in standard post-trade TCA reports

Request estimates

via an advanced REST API

FULL GLOBAL COVERAGE

ENHANCED BASKET FUNCTIONALITY

Covers over

150,000

Equities and ETFs globally

Quickly identify high-cost stocks in a basket

by analysing their individual cost contributions

Modify the basket interactively

and to re-evaluate the impact cost for the basket

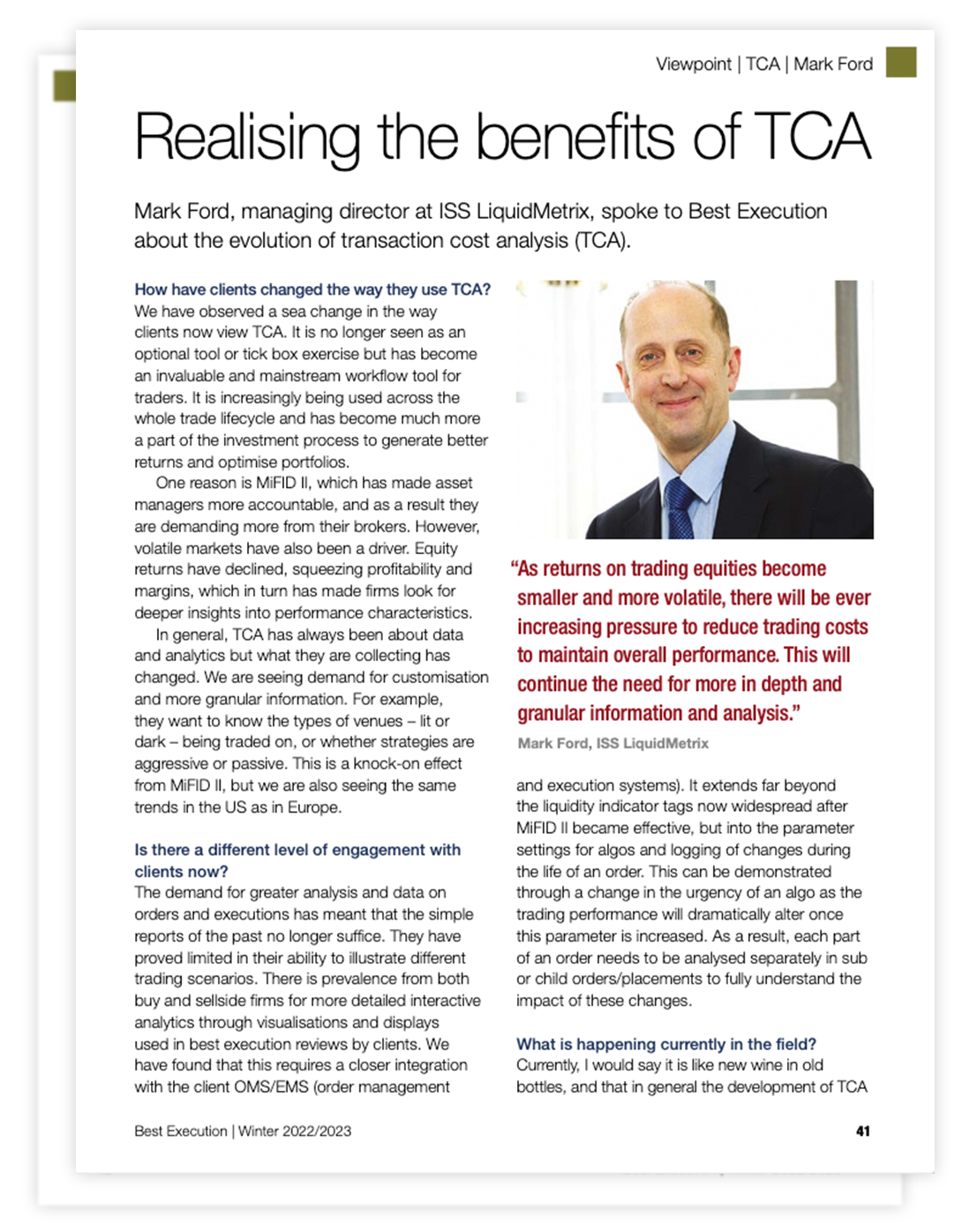

Realizing the benefits of TCA

Mark Ford, managing director at ISS LiquidMetrix, spoke to Best Execution about the evolution of Transaction Cost Analysis (TCA) and discusses how traders changed the way they use TCA:

“We have observed a sea change in the way clients now view TCA. It is no longer seen as an optional tool or tick box exercise but has become an invaluable and mainstream workflow tool for traders. It is increasingly being used across the whole trade lifecycle and has become much more a part of the investment process to generate better returns and optimize portfolios.”

Tactical solutions for monitoring and improving best execution and trading performance

ISS LiquidMetrix provides TCA, execution quality, market abuse and pre-trade analysis services across every public order and trade executed on all global venues. The LiquidMetrix platform is a proven core infrastructure that delivers a range of services to Buy Side, Sell Side, and Venue operators.

EXPLORE ISS LIQUIDMETRIX SOLUTIONS

TCA™

TCA™

An industry leading solution for Asset Managers and Brokers to measure trading performance and satisfy regulatory requirements on achieving Best Execution.

Surveillance™

Surveillance™

The LiquidMetrix Surveillance service provides a simple to use, but sophisticated system for the detection of potential Market Abuses and case management.

Venue Statistics™

Venue Statistics™

Business Intelligence on Trading Venues has become a key characteristic synonymous with Researchers, Quants, high performing trading desks and Execution Venues.

LM Research™

LM Research™

LiquidMetrix financial market data research is based upon our sophisticated advanced analytics and in-depth database of Global Market order books and trade data.

LIQUIDMETRIX WEBINAR ON ACHIEVING GREATER EFFICIENCIES IN TRADING

LiquidMetrix recently held a webinar of how firms can achieve greater efficiency in their trading.

We approached the topic from two different perspectives:

How can pre-trade cost models help traders become more effective in achieving superior trading performance.

Mark Ford of LiquidMetrix spoke with Robert Almgren of Quantitative Brokers on this topic.

How do Outsourced Trading Desks help their buy-side clients with Best Execution and creating trading efficiencies.

Henry Yegerman of LiquidMetrix discusses this with a panel of leading Outsourced Trading firms.

DATA COVERAGE

0

M

INSTRUMENTS

(SECURITIES)

0

%

WORLD MARKET

CAP COVERAGE

0

EXCHANGES

0