ISS ESG / CLIMATE SOLUTIONS

TCFD Solutions

Design and launch TCFD aligned reports to build strong climate investment strategies

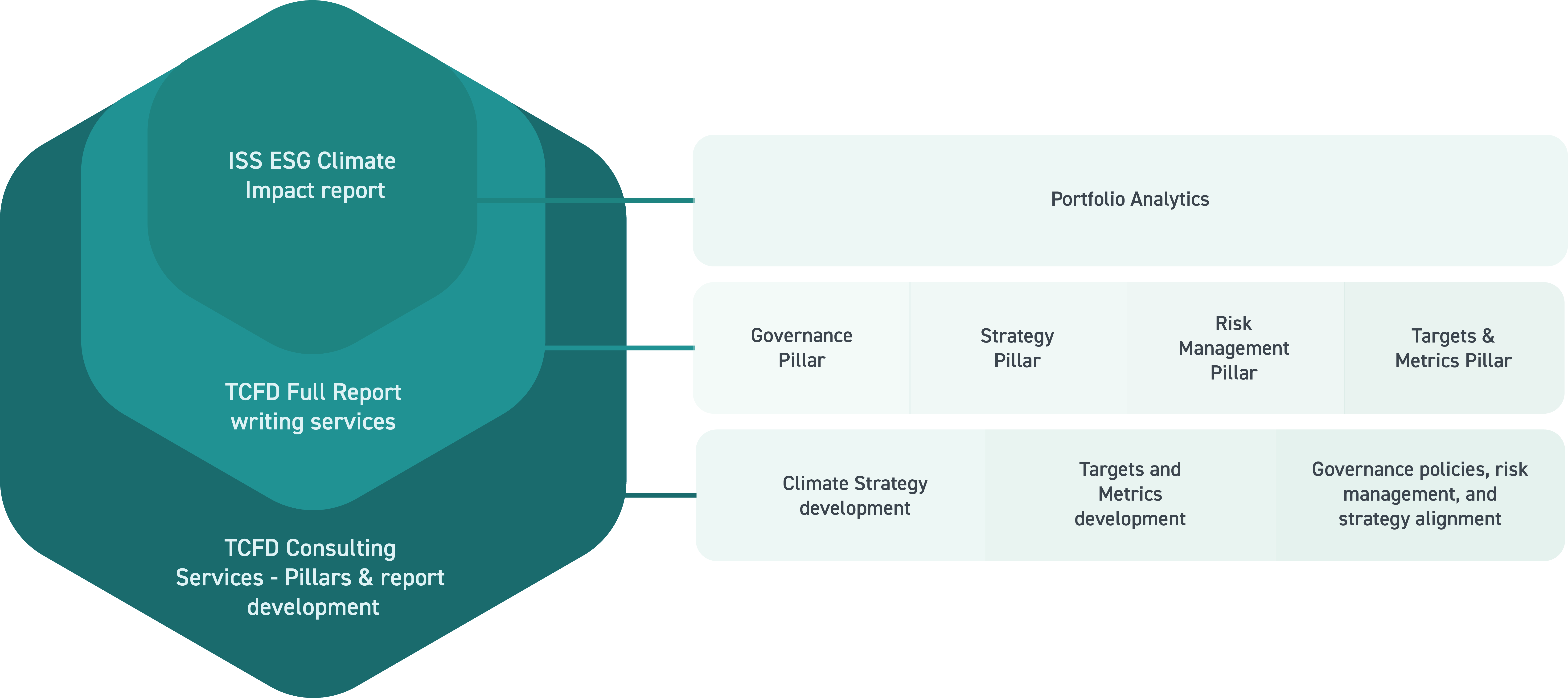

Investors can report their climate risks and opportunities aligned with TCFD recommendations using ISS ESG’s TCFD Solutions.

Whether investors already have a strong climate governance strategy and investment processes in place or are just starting on this journey, ISS ESG’s climate experts partner with clients at every step, to assess current processes, and tools to build strong climate investment strategies and to disclose and report TCFD requirements.

How can ISS ESG support investors in their TCFD journey?

ISS ESG’s dedicated consulting team can provide consulting services for projects upstream of writing a TCFD report, such as support to develop a climate strategy, pre TCFD requirement assessment in order to identify strengths and weaknesses and areas of further development across climate policies, processes, tools and resources used by investors through the investment lifecycle.

ISS can put in perspective in a very comprehensive way all relevant climate indicators investors need by conducting a full assessment of investors current climate-related governance, strategy and Risk Management structure through workshops and stakeholders’ interviews but also through in-depth review of clients’ publications and documentations on climate related policies, and investments processes in place.

ISS ESG can also leverage its carbon and climate indicators and portfolio analytics tools which provide in-depth analytics at the portfolio level in the form of a Climate Impact report.

Investors can choose to purely leverage ISS ESG’s Climate Impact report to directly report against TCFD recommended metrics and targets. ISS ESG’s portfolio analysis allows for a comprehensive answer to TCFD’s recommended cross-industry metrics, including TCFD’s Weighted average Carbon intensity and scenario alignment analysis with a 2 degree or lower scenario.

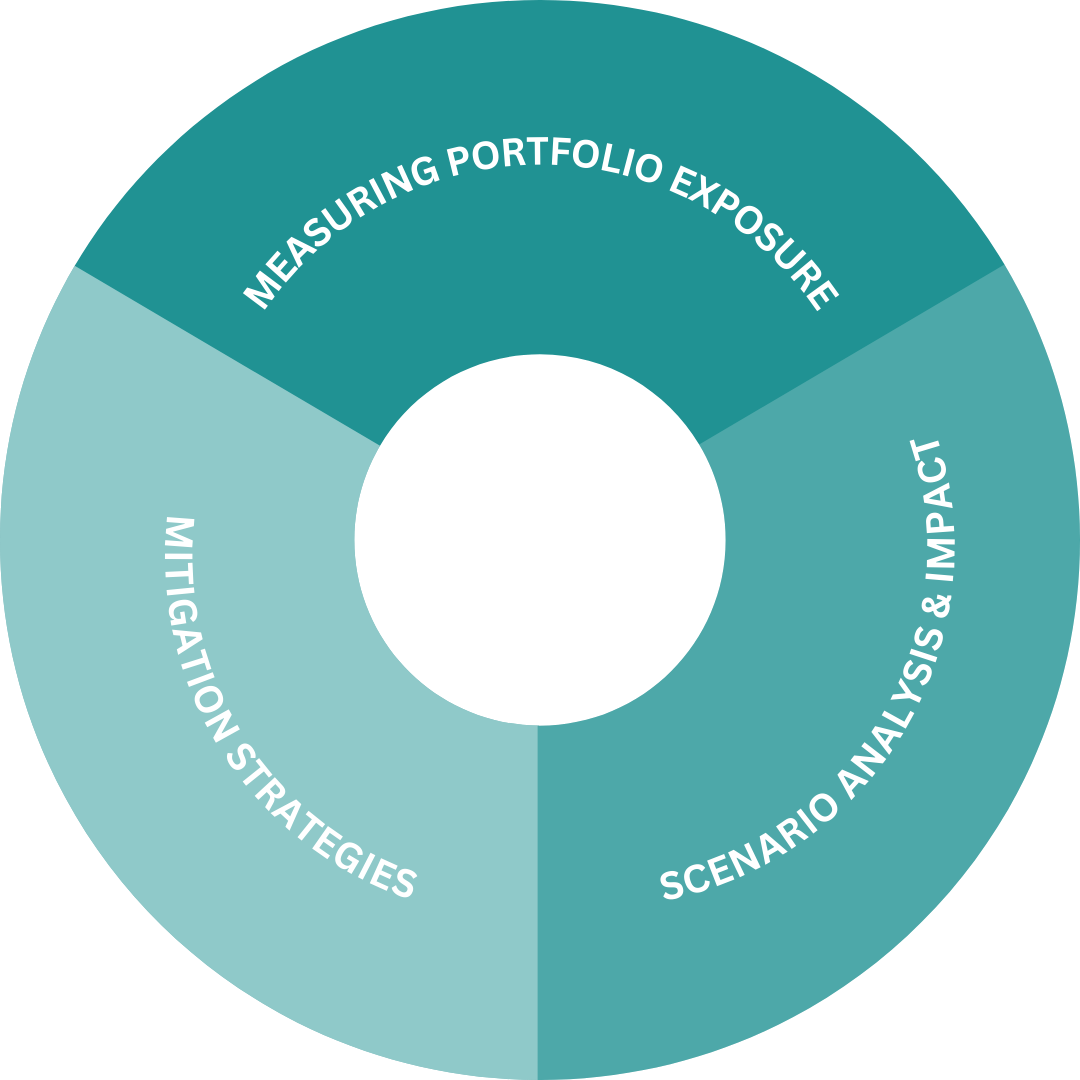

MEASURING PORTFOLIO

EXPOSURE

EXPOSURE

- Climate Metrics and Carbon Footprinting

- Transition Risks

- Physical Risk

SCENARIO ANALYSIS

AND IMPACT

AND IMPACT

- Scenario Alignment

- Physical Risk and Transition Risk Var

MITIGATION

STRATEGIES

STRATEGIES

- Portfolio Allocation

- Screening & Divestment

- Climate Opportunities

THE ISS ESG ADVANTAGE

0

+

Dedicated team of climate investing and financing specialists

0

+

Proprietary climate relevant sector and sub-sector specific models

0

K+

Issuers of equity and corporate debt with carbon & climate data coverage

Forward- looking analyses including a holistic view across climate risk and opportunities, covering both transition and physical risk

A climate data pioneer that ensures continuous innovation through new products & methodological developments

A recognized market leader in climate solutions

CLIMATE INSIGHTS & THOUGHT LEADERSHIP

REPORT

Physical Risks: Rising Tides