ISS ESG / CLIMATE SOLUTIONS

Climate Transition Value at Risk Solution

Assess your portfolio’s exposure to climate-related transition risks and opportunities and physical risk

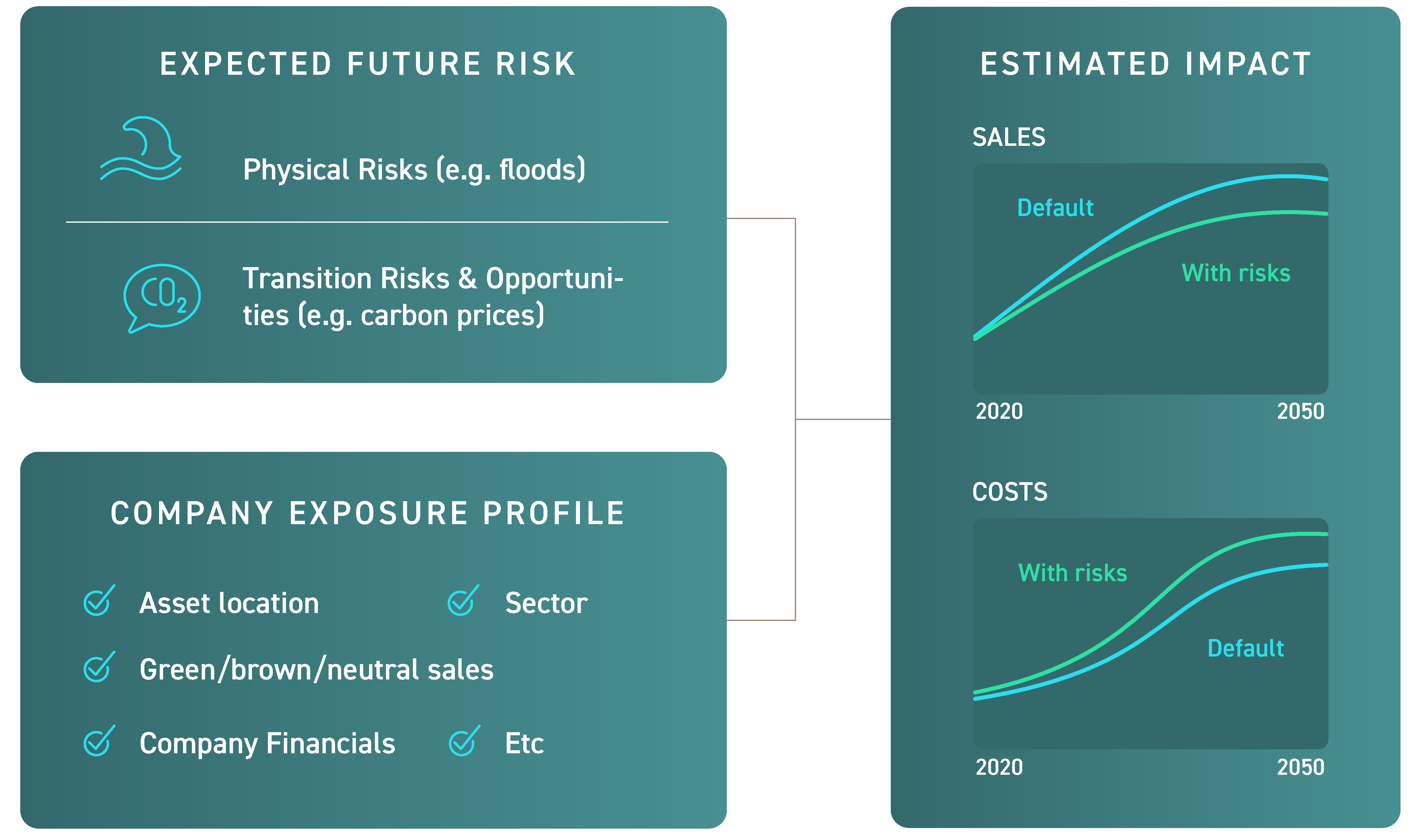

ISS ESG provides a holistic suite of solutions, including scenario-based assessments, to quantify risks and opportunities related to climate change. This covers both transition and physical risks and provides forward-looking insights.

Transition Risk Analysis

The Climate Transition Value at Risk Solution allows financial institutions to identify assets which may be most at risk from carbon pricing and demand changes, as well as those which may be better positioned to seize climate-related opportunities.

It provides forward-looking analysis allowing to quantify the impact of the International Energy Agency’s (IEA) Net Zero Emissions by 2050 and Sustainable Development Scenario on a portfolio and company level.

Physical Risk Analysis

The ISS ESG climate Physical Risk assessment gives an investor a holistic overview of their exposure to physical climate risks and the financial materiality of that exposure, based on each company’s specific profile.

The assessment covers current and future risk exposure, (Representative Concentration Pathways 4.5 and 8.5) to six of the costliest physical climate hazards: tropical cyclones, river floods, coastal floods, wildfires, heat stress and droughts.

WATCH THE VIDEO›

Both ISS ESG’s Transition Risk and Physical Risk VAR offer multi-scenario analysis that takes into consideration a company’s specific exposure profile and leverages a proprietary Economic Value Added (EVA) model to establish future financial risk.

This model offers clients a consistent, comparable and style agnostic financial valuation that cuts through accounting distortions and charges for the use of capital.

Climate Transition

Risk Rating

ISS ESG’s Climate Transition Risk Rating offers clients an analyst driven assessment that evaluates the extent a company copes with future challenges related to climate change and seizes opportunities arising from a transition to a low-carbon economy.

The Climate Transition Risk Rating assesses the climate-related performance of companies, taking into account not only industry-specific challenges and risk profiles but also a company’s positive impact in terms of climate and energy use.

THE ISS ESG ADVANTAGE

Dedicated team of climate investing and financing specialists

Proprietary climate relevant sector and sub-sector specific models

Issuers of equity and corporate debt with carbon & climate data coverage

Forward- looking analyses including a holistic view across climate risk and opportunities, covering both transition and physical risk

A climate data pioneer that ensures continuous innovation through new products & methodological developments

A recognized market leader in climate solutions