ISS ESG / CLIMATE SOLUTIONS

Climate Risk Analysis

Assess your portfolio’s exposure to climate-related transition risks and physical risks

TRANSITION RISK ANALYSIS

Carbon Risk Rating

Investors can seize opportunities arising from a transition to a low carbon economy by using ISS ESG’s Carbon Risk Rating’s analyst driven assessment that evaluates the extent a company is exposed to future challenges related to climate change.

The Carbon Risk Rating assesses the climate-related performance of companies, considering not only industry-specific challenges and risk profiles but also a company’s positive impact in terms of climate and energy use.

Transition Value at Risk

Identify assets which may be most at risk from carbon pricing and demand changes, as well as those which may be better positioned to seize climate-related opportunities with Climate Transition Value at Risk Solution.

ISS ESG’s Climate Transition Value at Risk Solution provides forward-looking analysis allowing to quantify the impact of the International Energy Agency’s (IEA) Net Zero Emissions by 2050 and Sustainable Development Scenario on a portfolio and company level.

WATCH THE VIDEO

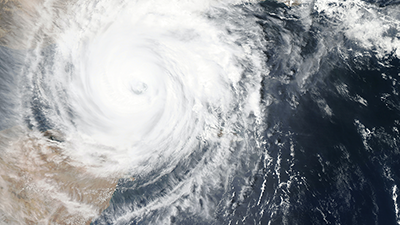

Physical Risk Analysis

ISS ESG’s Climate Physical Risk assessment gives the investor a holistic overview of their exposure to physical climate risks and the financial materiality of that exposure, based on each company’s specific profile.

The increase in occurrence and intensity of severe physical climate hazards will result in direct threat to financial stability with abrupt value losses and productivity losses and expose investors’ portfolios to a lot of risks.

With ISS ESG’s Physical Risk Assessment investors can model hazard intensity increases for likely and worst-case scenarios by 2050 across six of the costliest physical climate hazards: tropical cyclones, river floods, coastal floods, wildfires, heat stress and droughts.

Both ISS ESG’s Transition Risk and Physical Risk VAR offer multi-scenario analysis that takes into consideration a company’s specific exposure profile and leverages a proprietary EVA model to establish future financial risk.

This model offers clients a consistent, comparable and style agnostic financial valuation that cuts through accounting distortions and charges for the use of capital.

THE ISS ESG ADVANTAGE

Dedicated team of climate investing and financing specialists

Proprietary climate relevant sector and sub-sector specific models

Issuers of equity and corporate debt with carbon & climate data coverage

Forward- looking analyses including a holistic view across climate risk and opportunities, covering both transition and physical risk

A climate data pioneer that ensures continuous innovation through new products & methodological developments

A recognized market leader in climate solutions