ISS ESG / CLIMATE SOLUTIONS

Climate Impact Report and Data

Conduct a holistic analysis of climate-related risks and opportunities and their impact on investments.

Analyze your portfolio’s exposure to climate risks and opportunities, including transition and physical risks as well as other forward-looking analyses, across equity and fixed income strategies.

Supports Reporting on Key Disclosure Frameworks such as:

- Taskforce for Climate-related Financial Disclosure (TCFD)

- UN PRI

- Key Net Zero Target Setting Frameworks

KEY BENEFITS OF THE CLIMATE IMPACT REPORT AND DATA

CLIMATE INVESTING – THE NEXT STEP

Building on our Carbon Footprint Report and Data, the Climate Impact Report and Data offers broader and deeper analysis of an investment portfolio. The report and data feed covers scenario analysis and its impact on company valuations as well as transition and physical Value-at-Risk.

GUIDE INVESTMENT DECISIONS

The report and data provides investors with metrics and guidance that can be used to inform investment decisions, including forward-looking assessments provided by the Carbon Risk Rating.

MEASURE & ASSESS IMPACT

The metrics and insights provided in the Climate Impact Report and Data can provide investors with insight into how their portfolios are positioned and what steps they need to take via active engagement and dialogue to align their portfolios with their climate commitments.

INTERNAL/EXTERNAL REPORTING

The report and data cover key metrics to assess portfolios against their respective benchmarks and report on key disclosure frameworks such as the TCFD and PRI.

BEYOND THE CARBON FOOTPRINT

The ISS ESG Climate Impact Report and Data also includes:

TCFD METRICS

Receive key metrics to fulfill requirements for internal and external reporting initiatives such as the TCFD and PRI.

CLIMATE SCENARIO ALIGNMENT

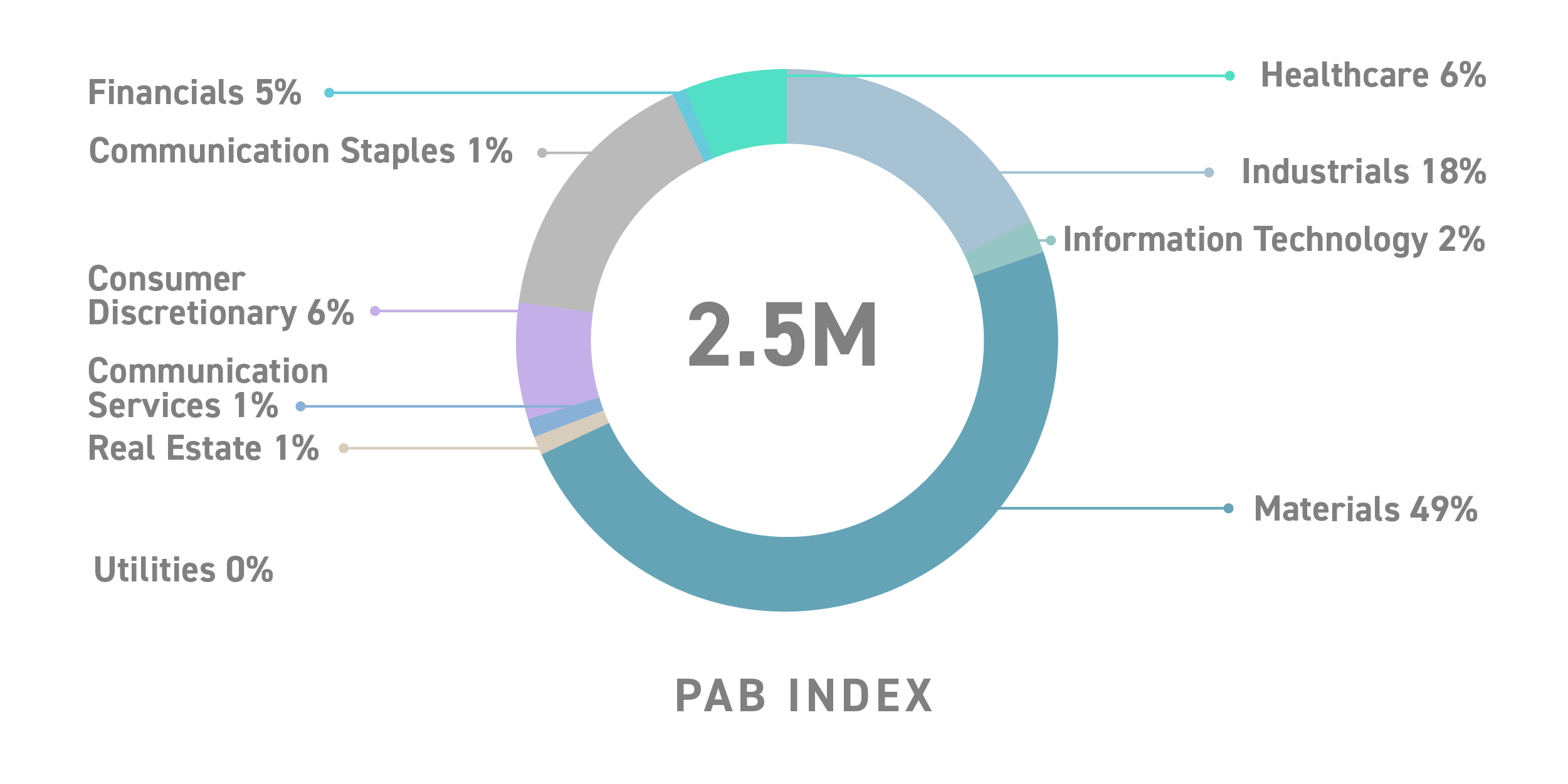

Assessment of company and portfolio alignment with key climate scenarios, such as a Paris-aligned scenario, including the portfolio’s carbon budget and potential implied temperature rise.

TRANSITION RISK ANALYSIS

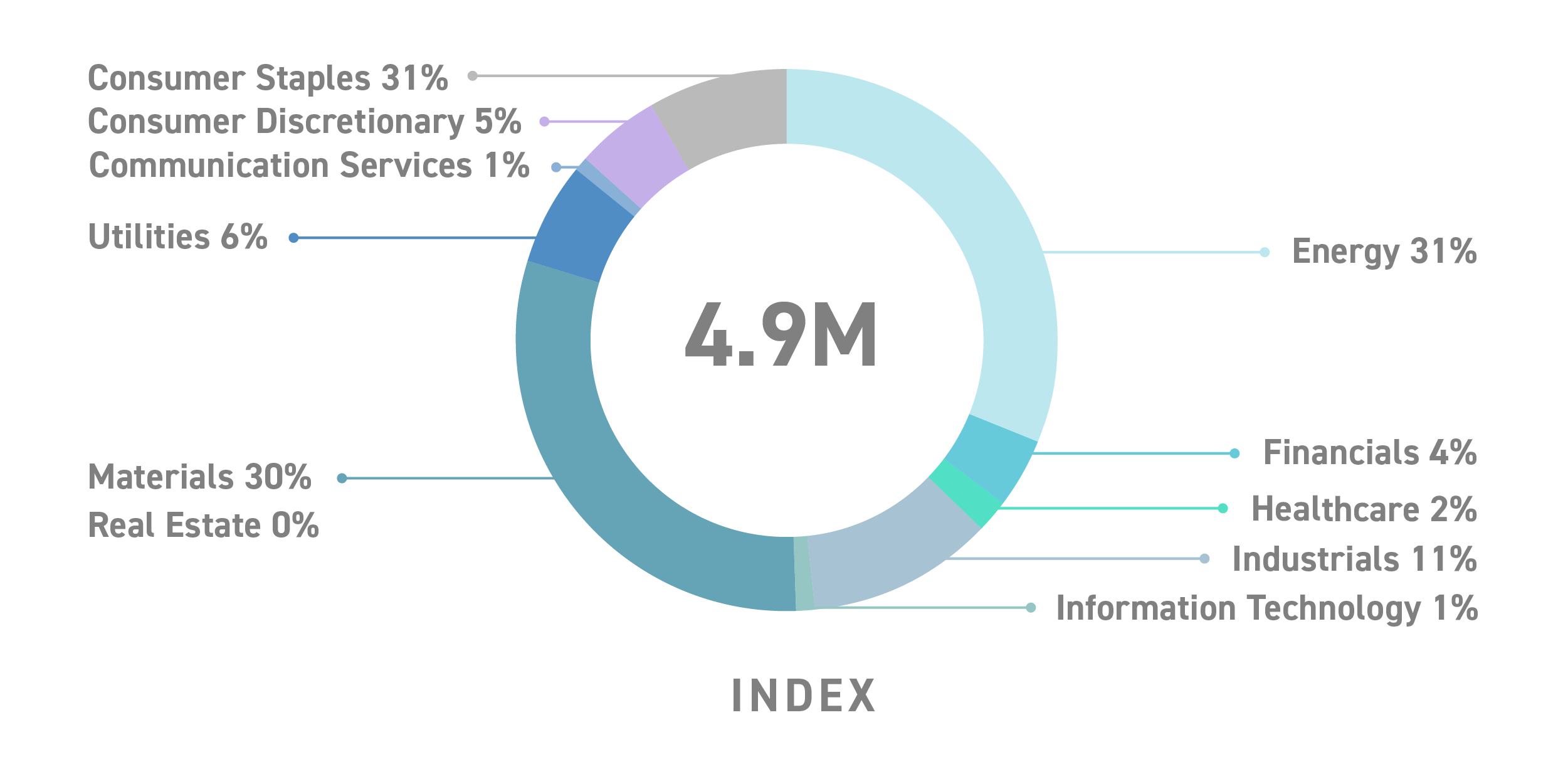

The Transition Value-at-Risk analysis quantifies company and portfolio exposure to transition risks and opportunities related to carbon pricing and demand changes. Further transition risks such as exposure to fossil fuel reserves, green and brown power generation, and controversial energy extraction practices are also assessed.

PHYSICAL RISK ANALYSIS

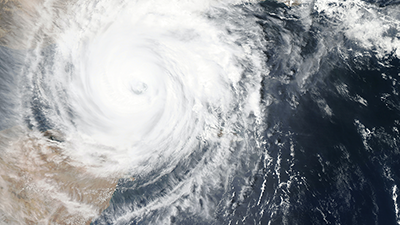

Provides Physical Value at-Risk analysis for companies and portfolios across the six most costly climate hazards: coastal floods, river floods, heat stress, wildfires, tropical cyclones, and drought. (Analysis covers both most likely and worst-case scenarios by 2050.)

NET ZERO ANALYSIS

Evaluates a portfolio’s readiness to transition to a Net Zero pathway by 2050 based on a highly granular assessment of companies’ disclosure, target setting, brown capital expenditures (CapEx), and green revenue.

CLIMATE CONSULTING

Looking for tailored support to sharpen your climate strategy or set net zero targets?

ISS ESG’s team of climate experts can support you with a range of bespoke consulting services.

TALK TO AN EXPERT ›

THE ISS ESG ADVANTAGE

0

+

Dedicated team of climate investing and financing specialists

0

+

Proprietary climate relevant sector and sub-sector specific models

0

K+

Issuers of equity and corporate debt with carbon & climate data coverage

Forward- looking analyses including a holistic view across climate risk and opportunities, covering both transition and physical risk

A climate data pioneer that ensures continuous innovation through new products & methodological developments

A recognized market leader in climate solutions