SUSTAINABILITY SOLUTIONS / CLIMATE SOLUTIONS

Climate Analytics

Manage your exposure to climate-related risks.

Providing Comprehensive

Carbon and Climate Data Solutions

Our dedicated team of experts provides market participants, governments and academics with market-leading carbon data and climate data as well as state-of-the art portfolio analysis tools.

Fulfill Reporting Requirements

Our reports are designed to support investors who want to align their portfolios to the goal of maintaining a 1.5°C trajectory, aligned to the Paris Agreement. Furthermore, these reports can help investors address key internal and external climate disclosures, including TCFD-based reporting initiatives where climate scenario analysis and scenario alignment are core elements of their disclosure requirements.

Portfolio Analytics – Corporates

Our proprietary analytics tools on our DataDesk platform enable investors to instantly assess climate risk portfolio exposure. For public equity and fixed income strategies, our Climate Impact Reports provide detailed analyses of Scope 1, 2, and 3 emissions, transition and physical risk and climate scenario alignment. Scenario alignment can be assessed against IEA, NGFS and OECM models, including scenarios aligned to Net Zero emissions by 2050 that are themselves based on the Glasgow Financial Alliance for Net Zero (GFANZ) recommendations.

Key Metrics – Corporates

AVAILABLE REPORTS: Climate Impact Report, Carbon Footprint Report

CARBON FOOTPRINT DATA

Provides comprehensive analysis of financed emissions across Scopes 1, 2, and 3. It includes sector-level breakdowns, issuer and sector attribution analysis, and historical emissions trends. To enhance transparency, a dedicated section assesses data quality and evaluates the reliability of emissions disclosures.

SCENARIO ALIGNMENT

Assessment of a portfolio’s alignment with up to 25 climate scenarios provided by leading models: e.g. IEA, OECM, and NGFS. The analysis includes implied temperature rise, cumulative alignment metrics, cross-point year, and transparency indicators.

TRANSITION RISK

Detailed assessment of company and portfolio exposure to transition risks and opportunities related to carbon pricing and demand changes, impacts on operating costs and revenues, fossil fuel reserves, power generation, and controversial energy extraction practices. Includes forward-looking returns-based analysis quantifying the potential financial impact of a net zero scenario.

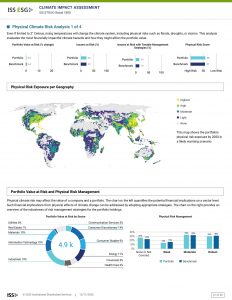

PHYSICAL RISK

Provides estimates of financial impact due to increasing hazard intensity for the most likely and worst-case scenarios by 2050 across the five most costly weather hazards: floods, heat stress, wildfires, tropical cyclones, and drought.

TCFD METRICS

Includes the TCFD’s weighted average carbon intensity and additional metrics assessing climate-related risks and opportunities.

STRESS TESTING

Analyze how different climate scenarios can impact the financial performance of your portfolio. Investors want to deepen their understanding of the financial impact of physical climate-related risks on their investments. With climate change expected to increase the occurrence and intensity of severe weather hazard impacts, the value of portfolio holdings could be adversely affected.

Portfolio Analytics – Sovereigns

We offer Climate Impact Reports for Sovereigns (including Sub-sovereigns), via our DataDesk platform. Our Sovereign Climate Impact Reports help analyze carbon emissions, scenario alignment, climate change policy, and transition risk at the Sovereign level. They also help carbon emissions analysis at the Sub-sovereign level.

They provide deeper understanding, more precise measurement, and facilitate clearer reporting when assessing Sovereign and Sub-sovereign climate-related risks. Furthermore, our forward-looking climate impact data allows investors to act with confidence in relation to their Sovereign portfolios.

Key Metrics – Sovereigns

AVAILABLE REPORTS: Climate Impact Report, Carbon Footprint Report

CARBON FOOTPRINT DATA

A framework that encompasses Scope 1, 2, and 3 emissions, including emissions from Land Use, Land-Use Change, and Forestry (LULUCF). It also involves analyzing emission intensity in relation to GOP-adjusted Purchasing Power Parity (PPP) and debt levels, providing a comparative perspective on efficiency and sustainability. Additionally, the framework includes benchmark comparisons to assess performance against industry standards and incorporates Partnership for Carbon Accounting Financials (PCAF) scores to evaluate climate-related financial impacts.

TRANSITION RISK

A risk assessment that focuses on several key factors influencing carbon exposure and energy dependency. It examines the fossil fuel usage of the top 10 issuers, evaluates the overall energy mix, and considers the impact of fossil fuel subsidies on market dynamics. Additionally, it analyzes the share of oil, gas, and coal reserves to understand resource concentration and long-term risk. The framework incorporates a Country Carbon Risk Rating to provide a comprehensive view of transition vulnerabilities across jurisdictions.

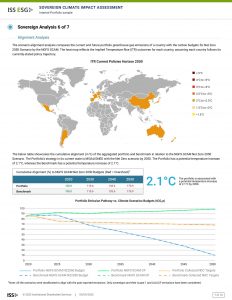

SCENARIO ALIGNMENT

Includes a heat map projection for 2050 under current policy assumptions, providing a visual representation of potential outcomes. It also examines portfolio-level cumulative alignment and the Just Transition Risk (JTR) at the 2050 horizon to assess long-term consistency with climate objectives. The analysis focuses on the top 10 holdings, comparing their performance under current policy scenarios and aggregated Nationally Determined Contributions (NDCs).

SUB SOVEREIGN ANALYSIS

Focuses on evaluating emissions exposure, specifically Scope 1 and LULUCF, alongside the country risk rating of the sovereign entity. This combined assessment provides insight into environmental impact and financial stability at the sub-sovereign level.

Climate Risk & Impact Data

Access the broadest and deepest carbon and climate dataset in the market

- Forward-looking assessment of the climate-related performance of companies, considering industry-specific challenges and risk profiles as well as companies’ positive impact.

- Assessment of companies’ involvement in the extraction of fossil fuels, and the generation of power from fossil fuels, nuclear and renewable sources.

- Proprietary analysis based on latest available peer-reviewed climate models (CMIP5)

- Includes Physical Risk Score allowing peer comparisons, Value at Risk and Physical Risk Management Score.

Assessment of a portfolio’s alignment with up to 25 climate scenarios provided by leading models:

- International Energy Agency’s World Energy Outlook 2022 (IEA)

- The United Nations Environment Programme’s One Earth Climate Model (OECM)

- The Network for Greening the Financial System (NGFS).

- Includes data on output and installed capacity derived from power generation from fossil fuels (coal, oil, and natural gas), renewable energy (wind, solar, hydro, biomass, geothermal, and nuclear power), and other sources.

Broad coverage with >180 Sovereign Risk Exposure and Climate Data factors, including:

- Absolute and intensity greenhouse gas emissions data from production emissions (as reported to the United Nations Framework Convention on Climate Change (UNFCCC)), aligned with the PCAF methodology

- Scope 1, LULUCF emissions and relevant emissions intensities of sub-sovereigns

- Includes the TCFD’s weighted average carbon intensity by scope. Transition Risk and Climate Policy Ratification, including data on sovereign energy mix and fossil fuel dependency and reserves.

- Alignment to Net Zero emissions by 2050 using climate scenarios provided by the Network for Greening the Financial System (NGFS).

- Alternative asset classes: e.g. private loans, real estate, and infrastructure

- Potential Avoided Emissions: e.g. companies, infrastructure, and green bonds

- Environmental Impact: e.g. deforestation and water

- Detailed assessment of absolute and relative Scope 1, 2 and 3 greenhouse gas emissions

- Bespoke analysis of transition and physical risk as well as scenario alignment possible

- Allows banks and insurance companies, that need to comply with mandatory climate-related disclosure frameworks, such as the Corporate Sustainability Reporting Directive (CSRD) and European Banking Authority (EBA) Pillar 3, to estimate emissions for non-listed companies, small and medium enterprises, and other alternative investments.