ISS ESG / CLIMATE SOLUTIONS

Carbon Footprint Report and Data

Take the first step in your climate investing journey

KEY BENEFITS OF THE CARBON FOOTPRINT REPORT AND DATA

CLIMATE INVESTING ESSENTIALS

Provides a detailed and clear assessment of a portfolio’s carbon footprint.

GUIDE INVESTMENT DECISIONS

Highlights drivers of over- and underperformance on carbon metrics versus a benchmark

MEASURE & ASSESS IMPACT

Supports investors in their approach to carbon risk management in line with their portfolio strategy.

INTERNAL/EXTERNAL REPORTING

The report or data feed covers key metrics that enable investors to assess their portfolios against their respective benchmarks and report on key disclosure frameworks such as the TCFD and PRI.

By conducting a carbon footprint analysis of your portfolio, you can identify high-risk companies that could have an impact on your portfolio’s performance:

Companies that do not

disclose emissions

Companies with a low carbon

efficiency per unit of output

Companies that are underperforming their peers on emission metrics

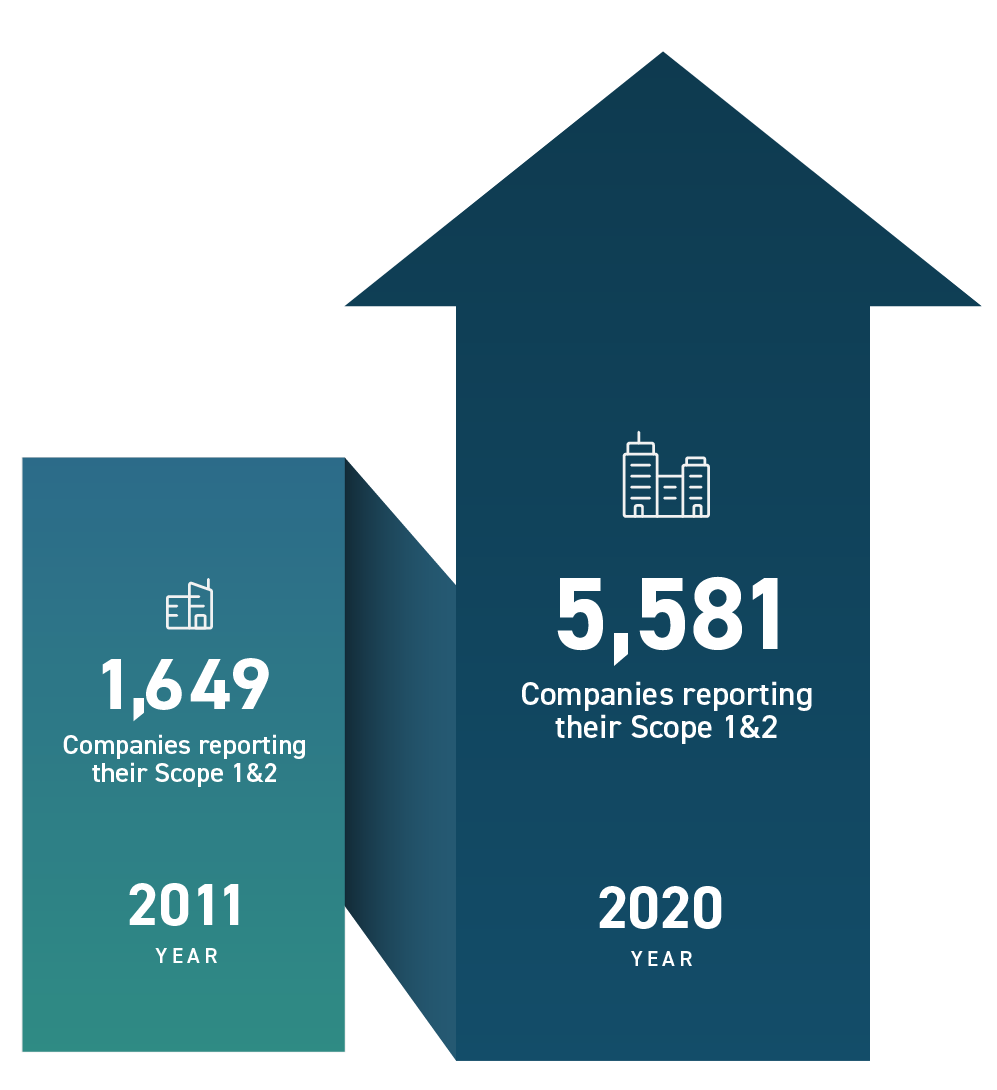

The number of companies reporting their Scope 1 and 2 emissions in 2020 was almost 3.5 times what it was in 2011

Source: ISS ESG

The Carbon

Footprint Report and Data

Available for download on ISS ESG’s proprietary DataDesk platform and supports investors with fulfilling requirements for internal and external reporting initiatives such as the TCFD and PRI.

Upload your portfolio to our Portfolio Analytics tool, select the relevant benchmark, and download the results in a matter of seconds.

REPORT COVERAGE

Scope 1&2, and

Scope 3 emissions

Carbon emissions per million USD/EUR of revenue

Top sectors and companies contributing to portfolio emissions

Weighted Average Carbon Intensity (WACI)

CLIMATE CONSULTING

Don’t know where to start?

Explore our dedicated consulting solutions.

ISS ESG’s team of climate experts can support you with a range of bespoke consulting services.

TALK TO AN EXPERT ›

THE ISS ESG ADVANTAGE

0

+

Dedicated team of climate investing and financing specialists

0

+

Proprietary climate relevant sector and sub-sector specific models

0

K+

Issuers of equity and corporate debt with carbon & climate data coverage

Forward- looking analyses including a holistic view across climate risk and opportunities, covering both transition and physical risk

A climate data pioneer that ensures continuous innovation through new products & methodological developments

A recognized market leader in climate solutions

CLIMATE INSIGHTS & THOUGHT LEADERSHIP