Recession fears, market volatility, low commodity prices, and high political risks – 2016 is looking a lot like 2015 for the Latin America region. The International Monetary Fund (IMF) projects that the aggregate GDP in the region (including the Caribbean) will contract once again in 2016, although not by as much as in 2015. Despite, or perhaps because of, the overall negative forecast, changes are expected for the upcoming proxy season, through new regulatory developments, the expectation of increased shareholder activism in an effort to mitigate the volatile environment, and the uncertainties triggered by high political risks in the region.

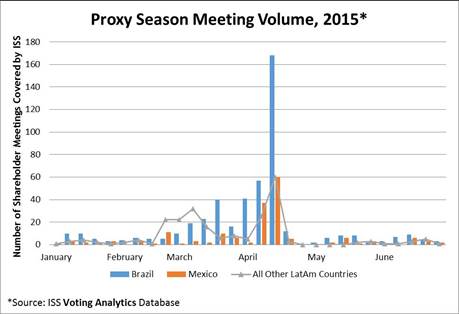

Latin America, including Brazil, has an earlier proxy season than other markets in Europe, North America, and some of Asia, with meeting volume beginning to increase in late February, and the peak running from mid-March until mid-April. After peak volume in mid-April, the number of meetings drops quickly, and Latin American proxy season has ended by May.

Latin America, including Brazil, has an earlier proxy season than other markets in Europe, North America, and some of Asia, with meeting volume beginning to increase in late February, and the peak running from mid-March until mid-April. After peak volume in mid-April, the number of meetings drops quickly, and Latin American proxy season has ended by May.

BRAZIL

Brazil’s high inflation, large fiscal imbalance, and low commodity prices have contributed to a lack of investor confidence and a downgrade of the country’s investment grade to junk status in 2015. A new Finance Minister, Nelson Barbosa, was appointed by president Rousseff on Dec. 21, 2015, with the role of improving the government’s deteriorating finances and dismal economic outlook. Barbosa replaced Joaquim Levy, who lasted for less than a year on the job.

Election of directors

Of approximately 180 Brazilian companies with election items on their ballots during the 2015 proxy season, at least 85 of them had minority shareholder (ordinary and/or preferred holders) elected representatives on the board of directors and/or the company’s fiscal council, under a separate election (including eight cumulative voting requests), in accordance with the Brazilian Corporate Law. That trend should continue for the upcoming proxy season, due to increased engagement and activism from minority shareholders.

ISS Voting Analytics data shows that at least 134 board and fiscal council minority shareholder representatives were elected during the 2015 proxy season, with at least 48 of them representing preferred shareholders.

The country’s regulator has provided clear guidelines for the disclosure of minority nominees in the event that the names are not available at the time of the publication of the meeting materials. Notices to shareholders must be filed with the CVM, and disclosed to the market, once the company receives the nomination of a minority board and/or fiscal council representative.

Nonetheless, timely disclosure remains one of the biggest challenges in this market, as Brazilian Corporate Law allows minority candidates to be presented for election up to the time of the meeting, preventing international institutional shareholders from having any visibility if new names and/or competing nominees are presented at the shareholder meeting.

MEETINGS TO WATCH IN 2016

Vale S.A.

The company is in the center of what is considered the largest environmental disaster in Brazilian history after a mining dam operated by its joint venture Samarco collapsed in the state of Minas Gerais, on Nov. 5, 2015, unleashing 60 million cubic meters of mud and toxic mine waste, destroying a town in its way, killing 19 people, and creating a massive devastation trail that reached the Atlantic Ocean. Police in Minas Gerais requested the arrest of six of Samarco’s executives, including the company’s former CEO Ricardo Vescovi, under charges of “qualified homicide” for the 19 deaths, as reported by the Wall Street Journal on Feb. 24, 2016.

Investors have filed a class action suit in the U.S. seeking reimbursement of losses, while the Brazilian government is seeking civil damages that could reach $7.2 billion. Vale was accused of not promptly or adequately responding to the disaster, and of trying to distance itself from Samarco, a joint venture between the Brazilian company and Australia’s BHP Billiton.

Petroleo Brasileiro S.A. (Petrobras)

Investigations into the unprecedented corruption scandal continue, and the government-controlled company is still trying to regain investor confidence. The company recently announced a new corporate governance structure and the creation of a number of different board committees. Expectations are high for the company’s upcoming AGM and board election, which is considered one of most high-profile meetings in Brazil.

LATIN AMERICA

In the rest of Latin America, a lack of transparency and timely disclosure remains among the biggest challenges for international institutional shareholders. Detailed information regarding the proposals to be presented for shareholder approval is generally disclosed at the time of the meeting or available only at the company’s headquarters. The election of directors and committee members is carried out as a slate election with very little or no information provided prior to the meeting.

Nonetheless, although bundled director elections remain the norm for the region (including Brazil), Latin America has seen modest but progressive improvement on the disclosure of board nominees. During the 2015 proxy season, 21 Mexican issuers, or roughly 20 percent of 106 companies with election proposals covered by ISS, disclosed the names of their director nominees prior to the meeting date, up from a total of 14 Mexican companies in 2014. –Renata Schmitt, Head of Latin America Research

The foregoing is taken from ISS’ 2016 Brazil and Latin America Proxy Season Preview. For the full report, Governance Exchange members may go here.